資產配置推薦——全球ETF配置策略

多元化均衡佈局,全球投資不設界限

uSMART投研團隊面向全球市場,基於宏觀經濟周期,基本面估值、資金層面、技術層面以及政策層面進行資產配置,嚴選優秀股債資產,力爭根據不同投資目標打造適合長期持有的配置型資產組合。

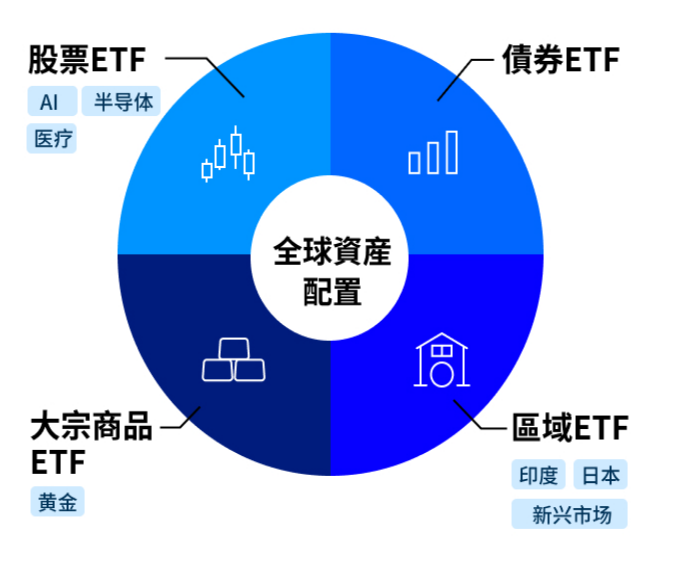

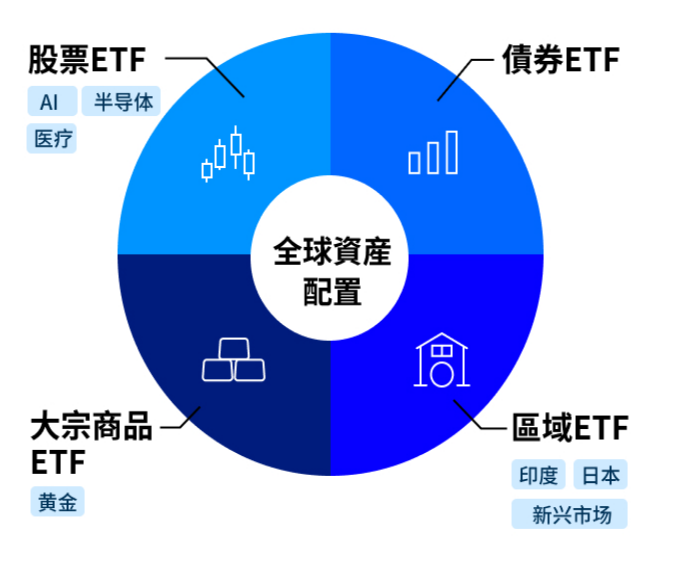

全球資產配置之ETF介紹

全球資產配置包括股票ETF、債券ETF、大宗商品ETF、區域ETF這四種投資工具。它們各自具有不同的風險和收益特性,能夠幫助投資者實現資產的多元化配置。

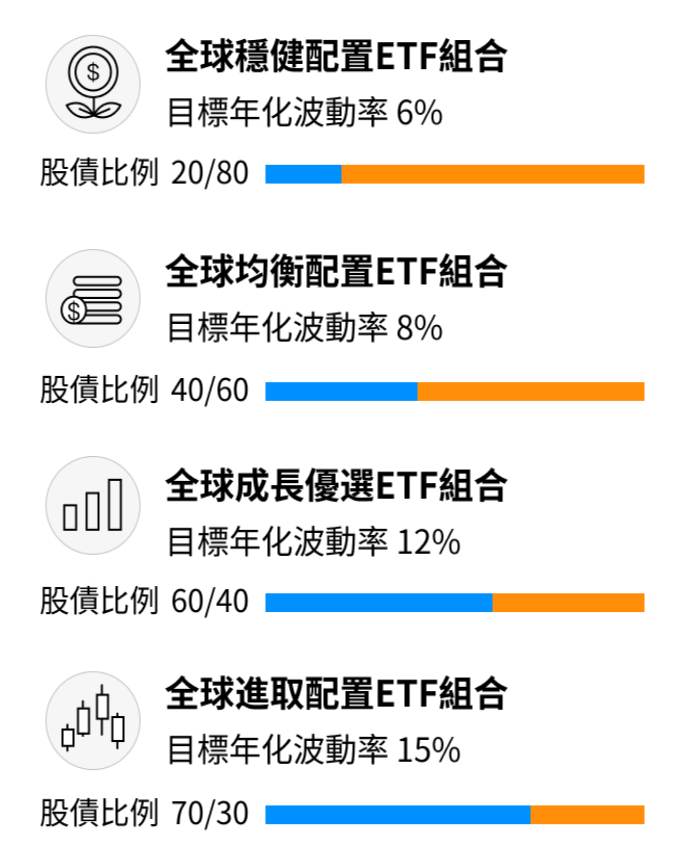

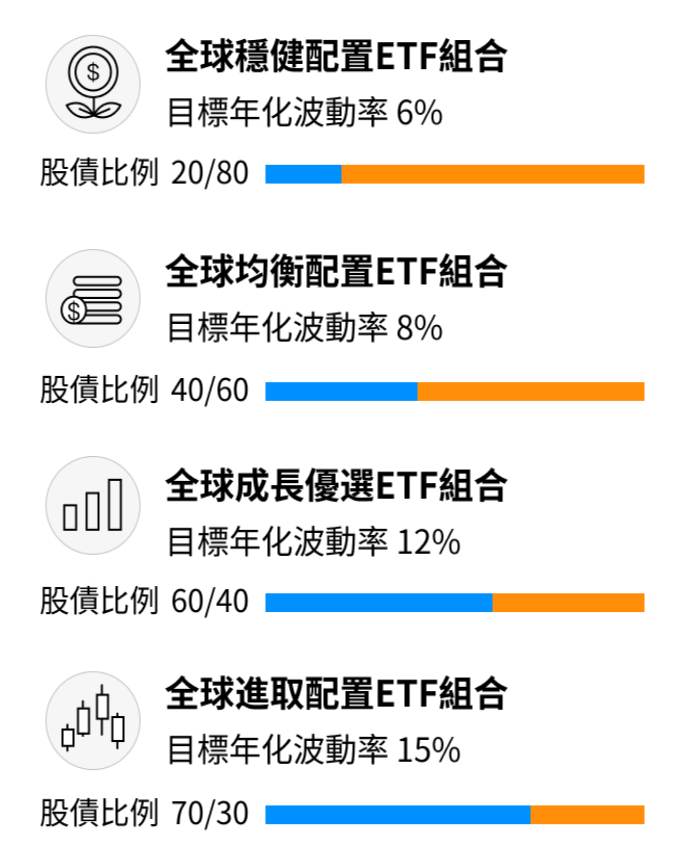

根據投資者的投資偏好和投資目標,uSMART按照不同的股債比例將ETF分為不同的組合,如全球穩健配置組合、全球均衡配置ETF組合、全球成長優選ETF組合、全球進取配置ETF組合。 根據投資者的投資偏好和投資目標,uSMART按照不同的股債比例將ETF分為不同的組合,如全球穩健配置組合、全球均衡配置ETF組合、全球成長優選ETF組合、全球進取配置ETF組合。

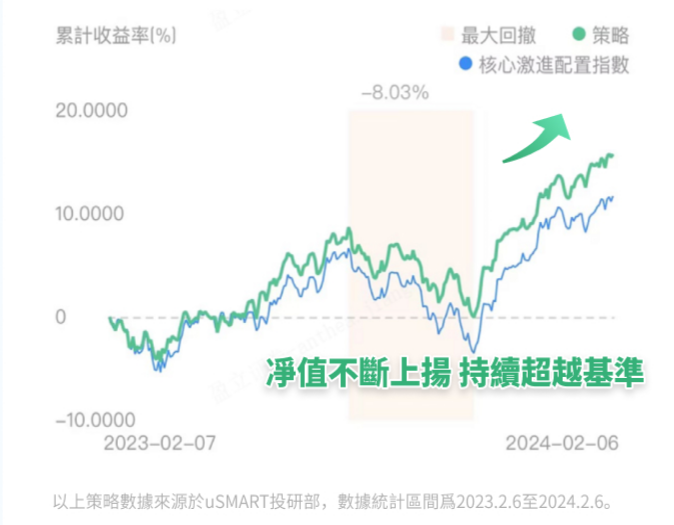

uSMART——業績能打,穩中求進

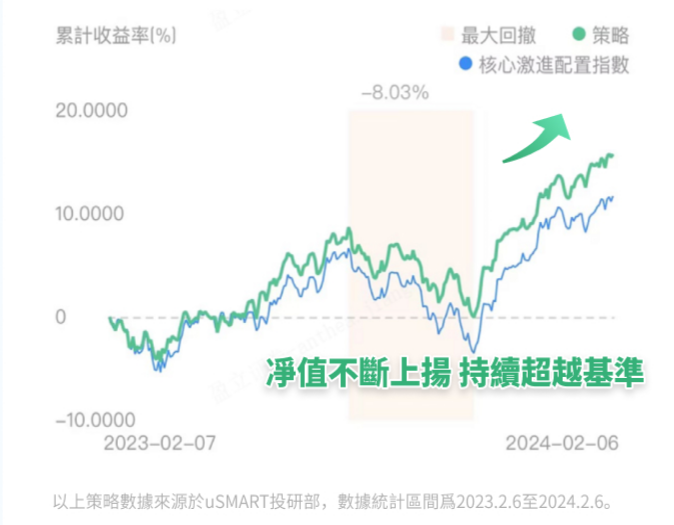

資產配置全球進取配置ETF基金組合業績走出亮眼表現,近一年收益超18.61%,超越基準(核心激進配置指數)約4%,力爭獲取長期穩健收益。

2023年,基於全球資產配置的理念驅動下,我們選取了股、債、黃金作為主要標的,其中,股票方面我們優中選優配置了美股、日本和新興市場,以及以半導體和醫藥為主的行業ETF,兼顧了進攻和防禦,且持倉資產分散並相對獨立。後市我們將繼續全球資產配置和價值投資的理念,其中將新興市場的倉位進一步集中在印度ETF上,長期看好印度經濟高速增長,並帶動印度股市攀升。其他資產我們目前維持預設倉位權重不變,偏離超過1%後會進行再平衡。

uSMART的三大優勢,幫你配置全球投資機會

● 更高標準要求,嚴選全球優質資產

通過量化模型、定性研判等手段,從全球市場多維精選優質股債標的,挖掘全球資產配置機遇。

● 股債均衡搭配,多種收益目標任君選擇

聚焦於持有者的收益目標,通過不同股債比例的搭配,有效降低市場波動率,中長期有望獲得更穩健的回報。

● 7*24小時監測策略,自動調倉省心安心

將在持有過程中幫您評估整體組合,監控每隻標的,每季度再平衡自動調倉,讓持有更加安心。

如何用uSMART HK 購買全球ETF配置策略:

登入uSMART HK APP之後,從頁面最下方點擊選擇「理財」,稍往下拉找到「全球配置-跟投易」,找到想投資的全球ETF組合後,點擊了解詳情,點擊右下角「開始理財」,最後輸入委託金額、交易條件後送出訂單即可。圖片操作指引如下:

此圖僅供說明之用

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.