On October 15, 2025, Federal Reserve Chair Jerome Powell stated in his latest remarks that the U.S. economy remains resilient, but inflation has not yet fully returned to the 2% target. Therefore, it is “not yet sufficient to confirm a sustained disinflation trend.” He emphasized that monetary policy will continue to be guided by “caution and patience” to avoid reigniting inflation through premature rate cuts.

Powell’s comments echoed the recent tone of several Fed officials — even as growth moderates, the Fed wants to see more concrete evidence of inflation easing. This stance has prompted markets to reassess expectations for rate cuts this year. According to CME FedWatch data, investors currently see around a 60% chance of a rate cut in December, slightly lower than before.

Inflation Resilience and Policy Delay

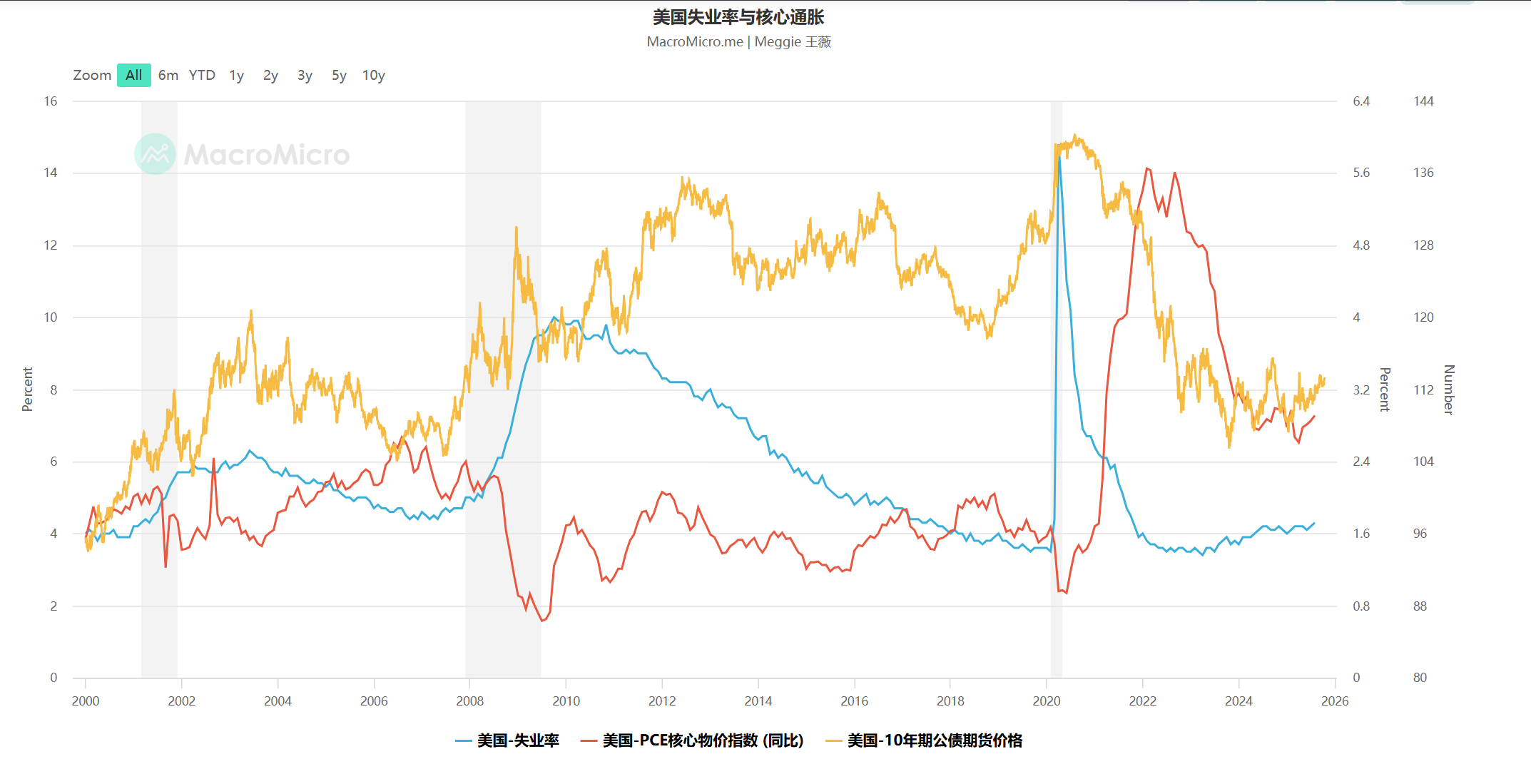

From a macro perspective, the U.S. labor market remains robust, with the unemployment rate hovering near 4%, while core PCE inflation is still above the target range — suggesting persistent price stickiness. Meanwhile, the 10-year Treasury yield has been trending lower, reflecting market uncertainty and caution regarding the future rate path.

This backdrop underscores Powell’s call for “patience”: although inflation is gradually declining, policymakers are reluctant to risk undoing two years of progress by easing too soon.

(Image source: MacroMicro)

(Image source: MacroMicro)

Market Reaction: Treasury Yields Rebound, Dollar Stays Firm

Following Powell’s remarks, U.S. Treasury yields rose in the short term, while the dollar index stabilized around 105 and the S&P 500 traded narrowly. Investor sentiment was mixed — on one hand, easing inflation gives room for potential policy relaxation; on the other, signals of a delayed rate cut are prompting short-term caution.

In the medium to long term, Powell’s stance reinforces expectations of a “soft landing,” with the Fed seeking to achieve price stability without triggering a recession. Analysts generally believe that this gradual approach helps contain volatility, though it also suggests that asset price fluctuations will persist in the near term.

Rate Dynamics: Implications for China and Hong Kong Markets

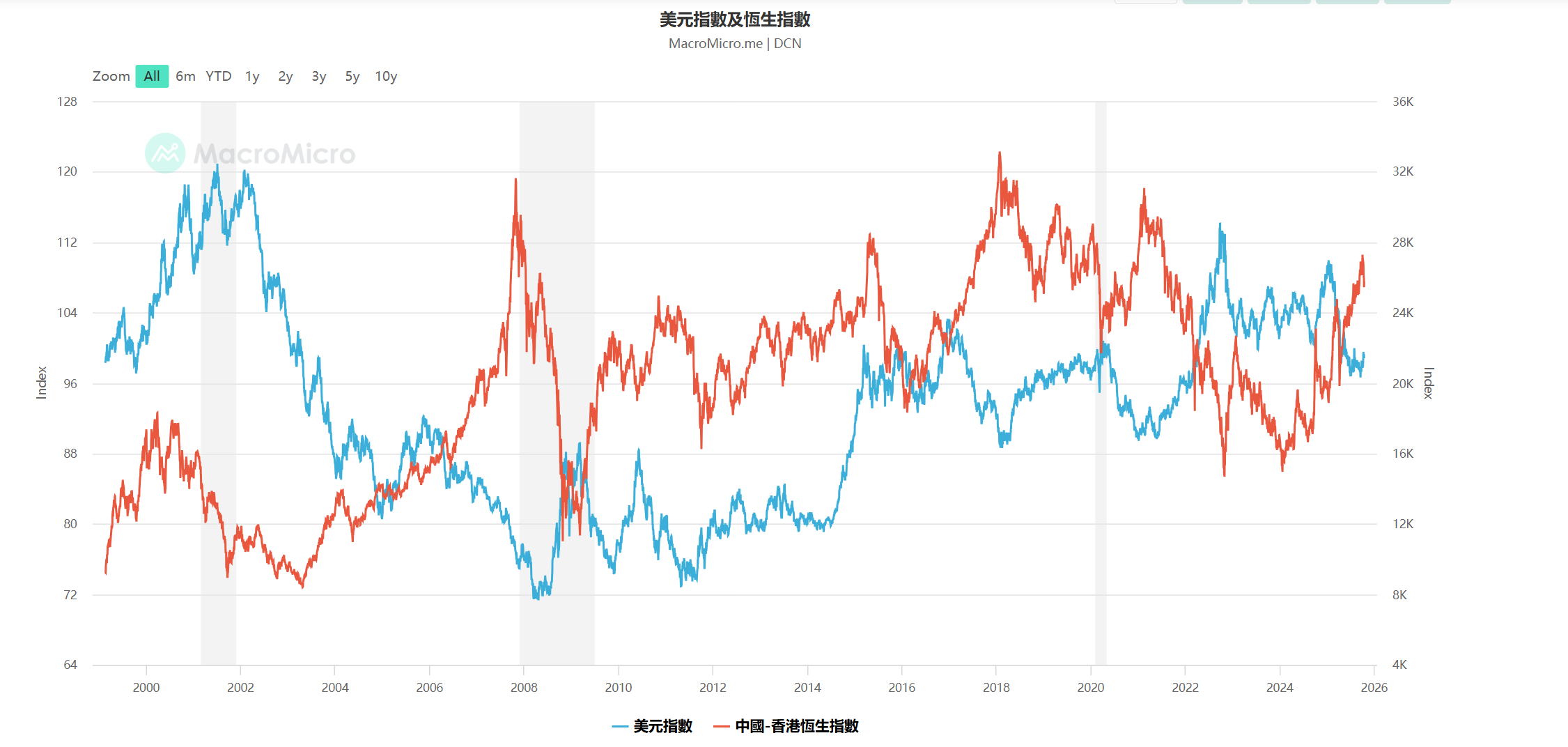

The U.S. dollar index and the Hang Seng Index have historically shown an inverse correlation. When the dollar weakens and the U.S. enters a monetary easing phase, Hong Kong stocks often benefit from capital inflows and valuation recovery. Conversely, a strong dollar typically exerts pressure on emerging markets through capital outflows. The dollar’s recent resilience has, to some extent, limited Hong Kong’s rebound potential.

(Image source: MacroMicro)

(Image source: MacroMicro)

For investors in China and Hong Kong, the Fed’s policy direction remains a key factor influencing asset pricing and capital flows. If the rate-cut cycle progresses and U.S. rates decline, global liquidity could improve, benefiting growth and small-to-mid-cap sectors. However, if inflation pressures persist and policy easing is delayed, valuations may come under renewed pressure. Overall, Powell’s emphasis on a “risk-free path” suggests that markets remain in a dynamic state of adjustment. In the coming months, policy outcomes and asset performance are likely to stay uncertain — requiring investors to maintain flexible allocation and balanced risk management.